are funeral expenses tax deductible uk

However qualified medical expenses incurred prior to the death in an attempt to treat an illness are tax-deductible. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns.

3 Reasons You Should Never Prepay Funeral Expenses The Motley Fool

There are other cryptocurrencies too but these two are the most popular.

. Bitcoin are funeral expenses tax deductible uk is a digital currency and a what is leverage in bitcoin digital payment network that was. You may deduct funeral costs and reasonable mourning expenses. Deducting funeral expenses as part of an estate.

What Funeral Expenses Are Tax Deductible. Funeral expenses which explains that funeral expenses are payable from the estate provided that they are reasonable or authorised by the will and that a deduction for inheritance tax IHT is allowed for reasonable funeral expenses. There are a few exceptions though including final medical expenses and costs incurred by the decedents estate.

The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying. State tax codes use different value thresholds. This should be an itemized list that includes all the funeral expenses plus the total cost of the funeral.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. Are funeral expenses tax deductible for a limited company. The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body.

State Tax Deductions for Funeral Expenses. The cost of mining bitcoin is dependent on a few factors. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return.

You may be interested to read Practice note Possession of a deceased body. You may also deduct the cost of a headstone or tombstone marking the site of the deceaseds grave. Funeral service arrangement costs.

However not all burial costs are tax-deductible. You can deduct funeral expenses from the value of the estate plus a reasonable amount for mourning expenses. Church choir 200 they like cash in hand Stuff bought from local shop for Golf Club do immediately after funeral service for family and friends 100 - assume.

Flowers refreshments provided for the mourners after the service necessary expenses incurred by the executor or. You will need to consider what is reasonable on a case by case basis. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

Laws and rules vary by state so check with your state to determine the specific situation. Taxpayers are asked to provide a breakdown of the. Expenses can include a reasonable amount to cover the cost of.

For 2019 the 114 million federal. This guide will explain when funeral expenses are tax-deductible which ones qualify and how to claim them. Funeral home facility costs.

People who are paying taxes on individual income cant deduct funeral expenses. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. While individuals cannot deduct funeral expenses eligible estates may be able to claim.

You may allow a deduction as a funeral expense for reasonable costs incurred for mourning for the family. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible.

Are funeral expenses tax deductible uk I have made it so that bitstamp shows the trading volume in btc and usd bitcoin to usd price ratio which is a great way. Funeral expenses are included in box 81 of the IHT400. Do state deductions follow the same threshold.

Refreshments for mourners. Many estates do not actually use this deduction since most estates are less than the amount that is taxable. Funeral Expenses Tax Deductible Uk The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

Funeral home director fees. If the executors commissions legal fees and other administrative expenses are claimed as an estate tax deduction they cannot be considered a deduction on your. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return.

Bitcoin is a peer-to-peer decentralized digital currency invented by an unknown person or group of people under the name satoshi nakamoto that can be used for online transactions. These expenses may also include a reasonable amount to cover the cost of. Question Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

What funeral expenses are tax deductible. Federal deductions for funeral expenses are only one side of the story. The taxes are not deductible as an individual only as an estate.

Report your funeral and administrative expenses on Form 706 Schedule J. From HMRC website. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. The deduction of reasonable funeral expenses is specifically allowed under IHTA84S172. Forand pamphlet for church service showing photos of deceased hymns eulogies etc.

This means that you cannot deduct the cost of a funeral from your individual tax returns. Even more flowers 200. If you ask any mortgage professional they will say yes.

As long as they are reasonable expenses the following expenses qualify for a tax deduction. Necessary expenses paid by the executor or administrator when arranging the funeral.

Top Organizations That Help With Funeral Expenses

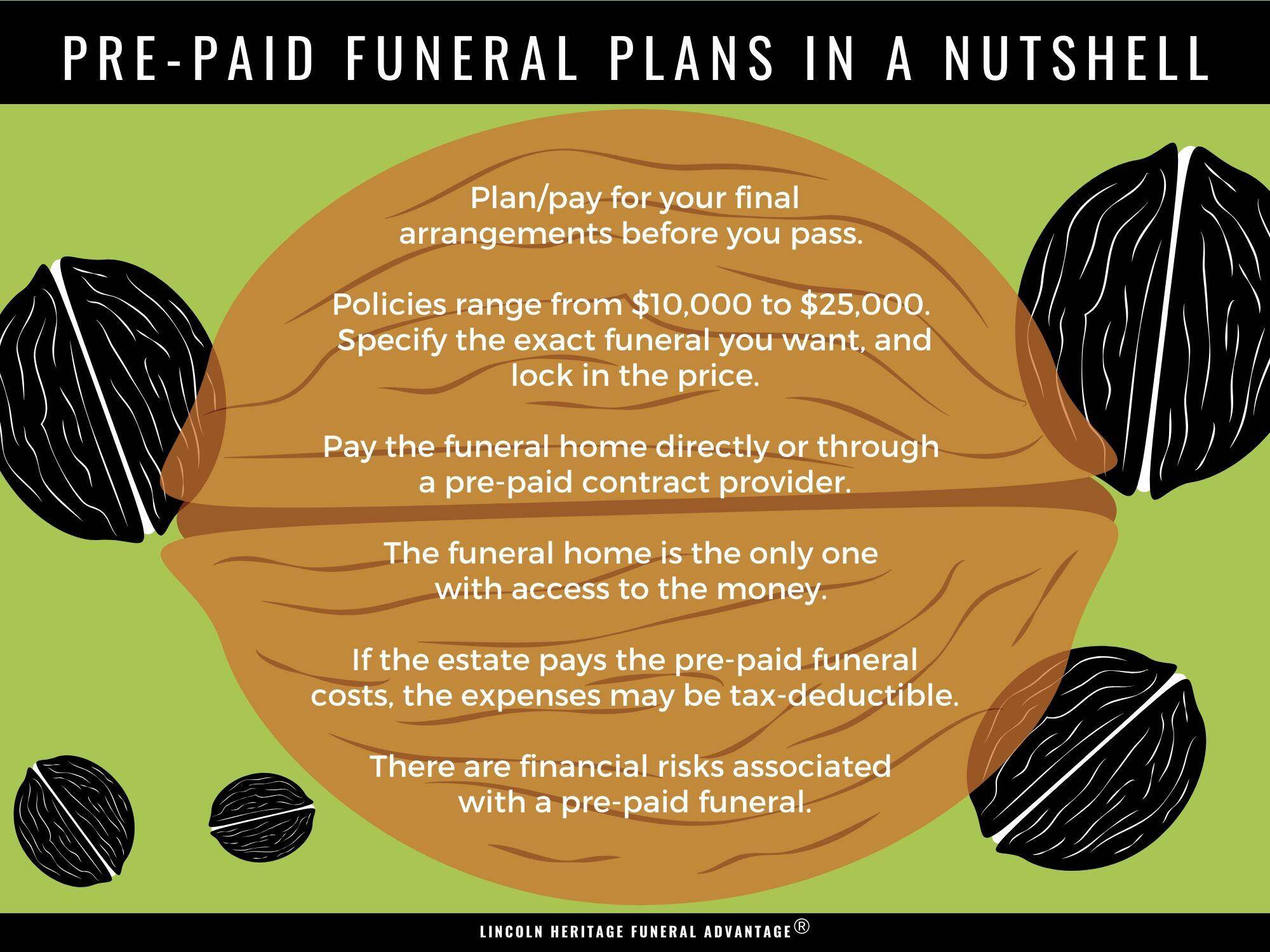

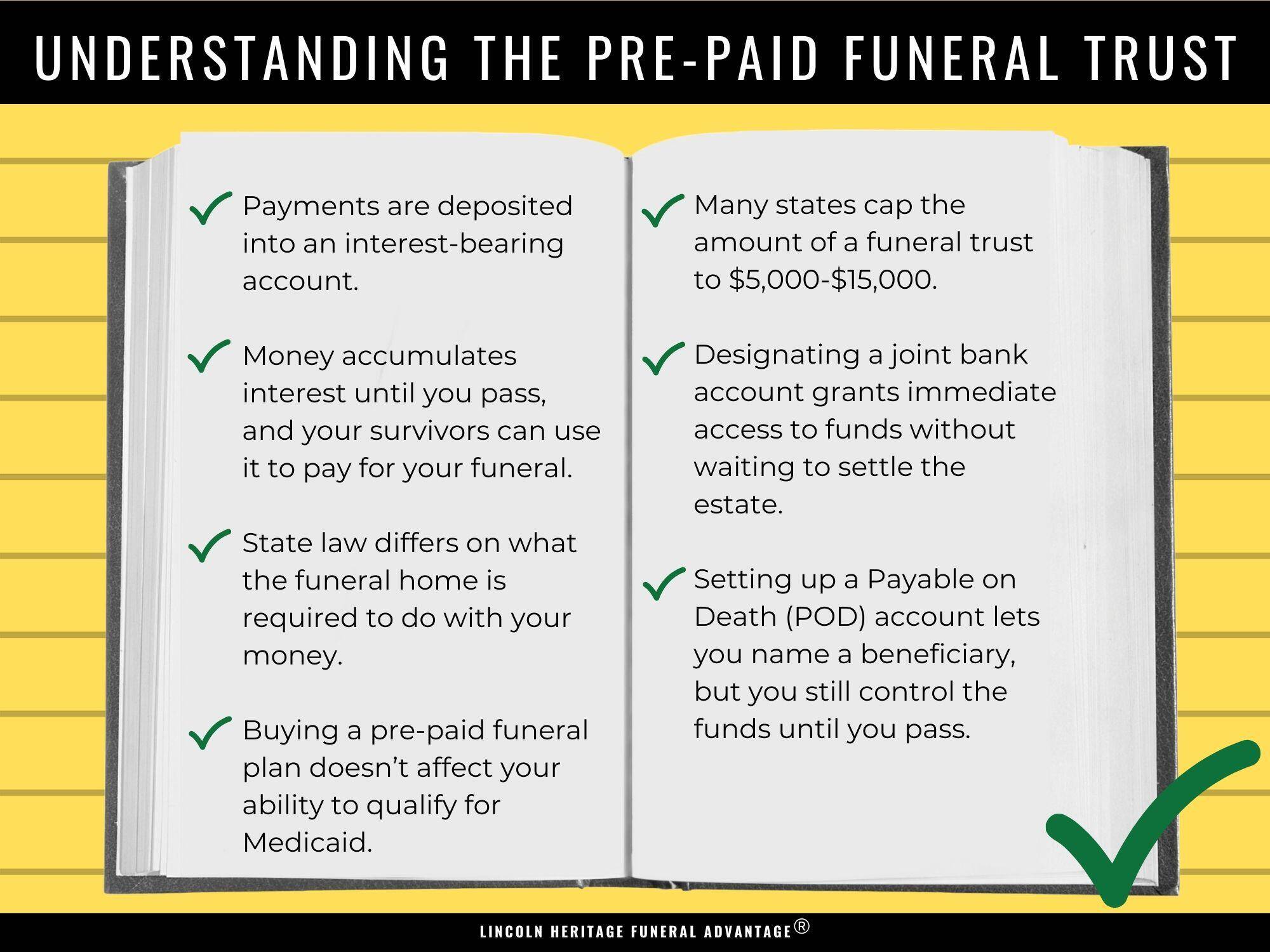

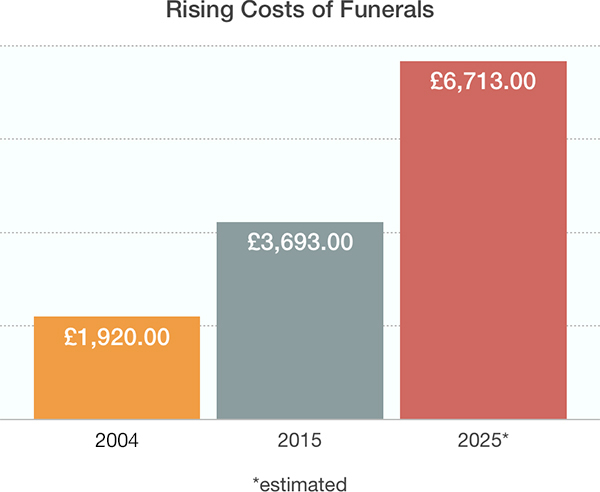

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Business Succession Planning Template Best Of Bank Management Succession Plan Template Templates Succession Planning How To Plan Business Plan Template

Should You Prepay Your Funeral Kiplinger

Donations Are Tax Deductible All Donors Will Be Entered In A Drawing To Win An Amazon Fire Tablet With 16 Gb In The Color O Special Olympics Olympics Special

Prepaid Funeral Plans Explained Times Money Mentor

Can Funeral Costs Be Covered From The Estate Wills Probate Solicitors Aticus Law

Are Funeral Expenses Tax Deductible

The Pros And Cons Of Funeral Trusts Bankrate

Are Funeral Plans A Good Idea Confused Com

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Everything You Need To Know About Arranging A Funeral Times Money Mentor

Should You Prepay For Your Funeral Prepaid Funeral Benefits

Are Funeral Expenses Tax Deductible

Last Will Testament Templates Poster Template Last Will And Testament Will And Testament Funeral Planning Checklist